Evident Financial Announces Promotion of Richard Makowski to Chief Investment Officer

Dave Cullen, CFA, CEO/Owner of Evident Financial is pleased to announce that Richard Makowski has been named Chief Investment Officer (CIO) at Evident Financial.

As a member of Evident Financial's leadership team, Richard is integral in setting the firm's investment vision and strategies. He oversees research, selection of asset classes and investment funds, and makes investment decisions in client portfolios.

Diversity is transitioning to ordinary at Erie Technology Incubator

The Erie Technology Incubator (ETI) at Gannon University’s Center for Business Ingenuity, 900 State Street, welcomed five new clients into its headquarters during the COVID pandemic. ETI is a nonprofit, university-based incubator dedicated to promoting business development through customized mentoring and linking internal and external resources to aid growth.

There is no questioning why businesses are downsizing, and/or shutting down during the COVID-19 pandemic. The stories of struggle and recover are unfolding daily in different ways across the United States. In Erie, Pennsylvania the stories are no different and the scars of the pandemic define a new normal for its economy. At Gannon University, ETI has seen a drop in occupancy creating a new story of retrenching and diversity.

2021 Economic and Political Outlook: What forces are shaping the U.S. economy as we enter the new year?

Participants in the webinar can expect to learn about the 2021 outlook for the economic, political, and financial market conditions in order to make sense of what is happening now and what could happen throughout the year. The webinar will conclude with a Q&A session with the presenters.

ETI Business Plan Boot Camp - 8 Weeks of Education

The Erie Technology Incubator is offering a Business Plan Boot Camp. This 8-week boot camp concentrates on a certain aspect of a business plan. The 8 weeks are broken out as follows:

- Introduction to a business plan

- Market and Competitive Analysis

- Advertising and Branding

- Pricing and Revenue Forecasting

- Management and Personnel

- Financial Projections

- Funding Sources

- Putting it all Together

Gannon's Erie Technology Incubator celebrates graduation of Evident Financial

The Erie Technology Incubator at Gannon University’s Center for Business Ingenuity, 900 State St., honored the successful graduation of client Evident Financial in October 2019, just one year after joining ETI. The graduation of an ETI client marks the end of the traditional incubator period. While Evident Financial has achieved this status, it will remain on-site with ETI as an affiliate company to provide support and mentoring services to current ETI clients.

Gannon’s Erie Technology Incubator Welcomes Four Clients In Fourth Quarter of 2019

The Erie Technology Incubator at Gannon University’s Center for Business Ingenuity, 900 State St., welcomed four new clients into its headquarters in the fourth quarter of 2019. ETI is a nonprofit, university-based incubator dedicated to promoting business development through customized mentoring and linking internal and external resources to aid growth.

GU. ETI and SBDC to support Erie’s Premiere Student Entrepreneurship Competition

Gannon University, Erie Technology Incubator and Small Business Development Center are proud to support Innovation Collaborative in Erie’s Premiere Student Entrepreneurship Competition.

Video Directives is one of 4 companies approved in March 2019 to receive an investment from Ben Franklin!

Congratulations to ETI Client Video Directives for being one of 4 companies approved in March 2019 to receive an investment from Ben Franklin!

Tenants at Gannon’s Erie Technology Incubator Receive Free Rent in Response to COVID-19

Gannon University announced on Tuesday that it would be canceling April rent for all tenants within its Erie Technology Incubator. This decision was a result of a unanimous vote by the ETI Board of Directors in response to the COVID-19 pandemic.

U.S. Rep. Thompson Discusses with Erie Technology Incubator about "The Great American Comeback"

Congressman spoke to 45 business leaders Friday shortly after voting on massive budget bill.

“We are witnessing what I think is the great American comeback,” Thompson, R-5th Dist., said during the Manufacturer & Business Association’s legislative luncheon.

Commitment to Erie

Local businesses make decisions every day that show their commitment to our community. Whether they choose local suppliers, support local charities, or contribute in some measurable way to the quality of life of their employees, they are committing to being a part of Erie’s future.

How to Cold Call & Build New Customers

We are proud to be sponsored by Erie Technology Incubator!

"Dale Carnegie wrote the original book on professional sales training," says Erie Technology Incubator. "We’re pleased to be partnering with the pioneers in the sales training arena to deliver high quality techniques, processes and tools to our portfolio companies and other members of the Erie business community."

BF Alum Company, Data Inventions, Receives Investment from CincyTech and NCT Ventures

CincyTech and NCT Ventures are pleased to announce investment in Data Inventions, a technology company that brings new life to conventional manufacturing. The Data Inventions platform adds a layer of front line analytics to traditional machine tools. The resulting insights enable midsize manufacturers to take immediate actions to get the most out of their operations, from materials, to the shop floor, to the bottom line.

Brightree Acquires Conduit Technology, LLC

Brightree LLC, the leading provider of cloud-based software to improve business and clinical performance of post-acute care organizations, announced today that it has acquired Conduit Technology, LLC, a leading provider of documentation and workflow solutions. Conduit Technology’s flagship product, Conduit Office, is the engine behind Brightree’s solution called MyForms.

Stop the Bleed campaign spread across Erie

ERIE, Pa - Tuesday May 23, 2017 - Trying to remain calm during a situation involving mass casualties is not easy, but it's important for the public to know how to step up and possibly save a life.

Very few people enjoy the sight of blood. But even if you can't stomach it, you should know how to handle it when it occurs.

Video Messages Clarify Patients' Wishes for Critical versus End-of-Life Care

Adding a patient-created video testimonial to a living will or "POLST" form can help to prevent errors of interpretation regarding the choice between life-sustaining treatment or allowing natural death in critically ill patients, according to a study in the March Journal of Patient Safety. The journal is published by Wolters Kluwer.

Fiber optics hold promise of replacing aging copper network

Erie's Velocity Network already has laid 400 miles of fiber, most of it for commercial customers. Now the company is shifting its focus to providing similar service to residential customers.

The tiny strands of optical fibers — 48 of which are bundled in a protective black cable — are no bigger than threads.

Without the fine coating that covers each glass fiber, the strands are sharp and dangerous to the touch.

But they are also filled with potential, according to Joel Deuterman, CEO of Erie-based Velocity Network.

Erie’s AcousticSheep debuts on QVC

By Jim Martin / jim.martin@timesnews.comProducts made by AcousticSheep, a company based in Millcreek Township, made their debut on the QVC shopping channel on Feb. 21.

Wei-Shin Lai, M.D., who invented the wearable headphones along with her husband, Jason Wolfe, appeared on QVC to demonstrate the product and to share the company's story with customers.

Gannon University’s Erie Technology Incubator Hosts Major Announcement

At the event, it was announced that InnovaTel Telepsychiatry, a member company at ETI, received an investment commitment of $2 million from Canyon Health Partners, a national private equity firm. "This investment capital allows InnovaTel to increase its capacity to meet the complex clinical needs of patients and our provider partners, and will further our efforts to expand into new states and create additional jobs," said Jon Evans, InnovaTel co-founder and CEO.

Video Statements Aimed at Improving End-of-Life Care

Breast cancer survivor Renee Hilditch is making sure she receives the proper medical care.

Hilditch is one 30 local patients to record a "My Informed Decision on Video" statement, or MIDEO. "I really would not want people to be hospitalized today, without MIDEO,” said medical director of UPMC Hamot’s Emergency Department Dr. Fred Mirarchi. “Especially, if they have to have a living will or a serious medical condition."

4 ETI Companies Presenting at Erie 2016 Homecoming Event

Erie Regional Chamber and Growth Partnership announced its plans for Erie Homecoming 2016, an event designed to stimulate conversation, new connections, and re-engage highly talented people that grew up here, went to school here, or worked here. The event is centered on better leveraging Erie’s network of former residents to speed our transformation by learning from their success and engaging them in our actions.

ETI Partners with Knox Law Firm and SBDC to Offer Legal Seminar

The Gannon University Small Business Development Center (SBDC), Erie Technology Incubator (ETI) and Knox Law are partnering to host an informational session on Wednesday, November 2, 2016 from 11:30 a.m. to 1:15 p.m. regarding a pivotal change to overtime regulations beginning December 1, 2016. Individuals are encouraged to register early, due to limited seating. Cost is $15. Registration begins at 11:00 a.m., lunch will be provided, and the event will take place in Room 300 of Gannon’s Center for Business Ingenuity at 900 State Street.

Vincent joins economic development team in Corry

ERIE, Pa. -- Katrina Vincent, former CEO of DevelopErie, is back to doing familiar work at a new organization.

Vincent, who left DevelopErie in May after the Greater Erie Industrial Development Corp., one of its affiliates, filed for bankruptcy protection, has been hired as real estate director for the Corry Redevelopment Authority.

Meanwhile, her new boss, Rick Novotny, executive director of the both the Corry Redevelopment Authority and the Erie County Redevelopment Authority, is taking on some of the work that once fell under the DevelopErie umbrella.

Erie doctor opens office to help with end-of-life decisions

ERIE, Pa. -- Mike Gallagher now carries two medical cards in his wallet in case he needs emergency treatment.

One is a Medicare insurance card, while the other looks like a driver's license but is actually a medical identification card. It provides emergency department physicians and nurses with vital information, including what lifesaving measures Gallagher is willing to have done.

Gannon University’s Erie Technology Incubator Celebrates ‘Graduation’ of Acoustic Sheep

Celebrating the accomplishments of graduates is an everyday thing at Gannon University-when those graduates are people. On Wednesday, July 27, a celebration honored a different type of graduate: a very successful company.

That company is Erie-based AcousticSheep, LLC, maker of wearable headphones for sleeping and running and a company nurtured at Gannon University's Erie Technology Incubator (ETI).

RendrFX Announces VideoBlocks Stock Media Now Available for Online Video Creation

RendrFX Announces VideoBlocks Stock Media Now Available for Online Video Creation PA-based RendrFX now offers over a half million royalty-free studio quality HD videos, images and music to enable customers an easy way to add stock content and easily create custom videos for social media, websites and online marketing needs.

Erie County Gaming Revenue Authority invests in loan fund to boost small business

ERIE, Pa. -- Three Erie companies -- a microbrewery, a day care center and a manufacturer of LED lights -- share one important trait.

Leaders of all three said Tuesday that they owe their existence to funding from Bridgeway Capital, a Pittsburgh-based community development financial institution that has made $6.5 million in loans to Erie businesses since opening a local office four years ago.

Wei-Shin Lai, M.D., has been named PA Small Business Person of the Year by the U.S. Small Business Administration

The statewide winners were announced Monday. Winners from the 49 other states, the District of Columbia, Puerto Rico, Guam and the U.S. Virgin Islands will compete May 1-2 in Washington, D.C., for the honor of National Small Business Person of the Year.

Student-led group wins Gannon's $10,000 business prize

ERIE, Pa. -- It started as a class assignment for a handful of Gannon students.

By Thursday morning, DaBull, a technology app they developed, had emerged as something else -- a standout in a business pitch contest and the winner of Gannon's fifth Technology Business Accelerator.

Gannon University Announces Fifth Technology Business Accelerator Winner

DaBull (pronounced "dabble") was announced as the fifth winner of Gannon University's Technology Business Accelerator business pitch event this morning at Gannon's Center for Business Ingenuity. The winning entrepreneurs received a grant for $10,000; six months of residency, coaching and strategic mentoring from the Erie Technology Incubator at Gannon University; legal assistance from MacDonald Illig and MMI Intellectual Property; and one year of e-commerce training provided by Ben Franklin Technology Partners' eMarketing Learning Center.

Education notes for Dec. 13

Edinboro offers same-day admission decision

Prospective Edinboro University of Pennsylvania students can complete the application process and receive an admissions decision on the same day as part of Edinboro's "On the Spot" admissions events.

The events will be held in the EU Admissions Office in Academy Hall, 200 E. Normal St., Edinboro, from 9 a.m. to 4 p.m. on Tuesday and from 3 to 7 p.m. on Thursday.

Gannon University Announces Exciting New Opportunities for Local Entrepreneurs

The Erie Technology Incubator at Gannon University (ETI) announced today that it will offer two additional programs to assist area entrepreneurs in early 2016.

The first program is a continuation of the University's successful Technology Business Accelerator, which debuted in September, 2014 and has trained nearly 75 entrepreneurs representing 48 businesses and concepts.

Gannon unveils grant program for entrepreneurs

ERIE, Pa. -- A grant of $3,000 or even $9,000 won't build what could be Erie's next big homegrown employer.

But for a fledgling company at the starting gate, that sum could be the difference between success and failure, said W.L. Scheller II, dean of the college of Engineering & Business at Gannon University.

That was the inspiration behind an announcement made Wednesday, at the Erie Technology Incubator at Gannon, to offer grants of between $3,000 and $9,000 through a new program called Gannon Entrepreneuriship Microgrants for Startups, or G.E.M.S.

Gannon University Student-Led Business Wins Technology Accelerator Award

Khonsu, LLC was announced as the fourth winner of Gannon University's Technology Business Accelerator business pitch event this morning at Gannon’s Center for Business Ingenuity. The winning entrepreneurs received a check for $10,000; six months of residency, coaching and strategic mentoring from the Erie Technology Incubator at Gannon University; legal assistance from MacDonald Illig; and one year of e-commerce training provided by Ben Franklin Technology Partners’ eMarketing Learning Center.

State Official Tours Erie Incubator

Out of the Grey Coffee blends custom coffee. Innovated offers psychiatric counseling via videoconference. AcousticSheep makes headphone headbands to wear while sleeping.

These were three of the businesses featured when state Community and Economic Development Secretary Dennis Davin toured Gannon University's Erie Technology Incubator on Monday.

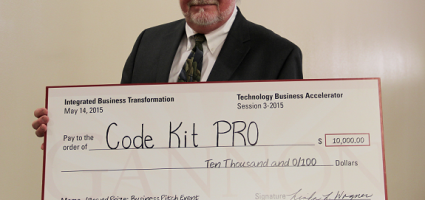

Locally Developed Pediatric Medical Product Wins Gannon University’s Third Accelerator

Code Kit PRO's Pedi-PRO platform resuscitation organizer became the third winner of Gannon University's Technology Business Accelerator business pitch event this morning. The winning team went home with a $10,000 check, legal assistance from MacDonald Illig Jones & Britton LLP, along with six months of residency, coaching and strategic mentoring from the Erie Technology Incubator (ETI), which is located in Gannon's new Center for Business Ingenuity at 900 State Street.

Gannon University Hosts Grand Opening and Blessing At New Center for Business Ingenuity

Gannon University dedicated the new Center for Business Ingenuity at 900 State St. in the heart of Erie's central business district. The Center will be home to the University's Dahlkemper School of Business, Erie Technology Incubator (ETI) and Small Business Development Center (SBDC), and will facilitate a robust exchange of ideas between business students, faculty, entrepreneurs, young and expanding businesses.

Gannon grant boosts Erie self-defense business

It's an unlikely business, built on what looks like a designer keychain by owners with years of experience in martial arts and marketing.

But a five-member panel of judges came away impressed by an idea hatched by Phil Ventrello and Michele Vorberger, the owners of Munio Self Defense. Their business was chosen from among 11 entrants as the winner of the Gannon University's Technology Accelerator Award.

KIZ Seminar to be Presented at ETI on April 20.

The Technology Council invites you to attend the Keystone Innovation Zone Tax Credit seminar. This event, presented by Colton Weber of the Pennsylvania DCED, will cover KIZ Tax Credit eligibility, application process, and utilization options. KIZ Tax Credits are non-competitive, can be received multiple consecutive years, and can total $100,000 annually.

Gannon University’s Technology Business Accelerator Award Winner Announced

The winner of Gannon University's Technology Business Accelerator business pitch event went home with a $10,000 check, along with six months of residency, coaching and strategic mentoring from the Erie Technology Incubator and legal support services from Erie law firm MacDonald, Illig, Jones, & Britton LLP this morning.

Dream Team Entrepreneurs: Erie's AcousticSheep

Wei-Shin Lai and husband Jason Wolfe made their first SleepPhones at their kitchen table in Bellefonte, near State College, in 2007.

Lai, then a private practice physician, had trouble getting back to sleep one night after a wee-hours call. Her husband suggested that she listen to soft music, but she could find no earphones or headphones comfortable enough to sleep in. So husband and wife decided to make and market their own.

Searching for the Spirit of the Erie Entrepreneur

Erie Insurance and Lord Corp. rank today among Erie's best-known and largest employers.That's not all they have in common.

Both began life 90 years ago, growing from the vision of Erie entrepreneurs.

Lord Corp., with more than 850 employees in Erie County, was born of frustration when patent lawyer Hugh Lord couldn't find anyone to manufacture the products he had invented.Erie Insurance, with more than 2,100 local employees, was the brainchild of H.O. Hirt and O.G. Crawford, middle-aged insurance salesmen who thought they could do better.

Erie Company Plans to Offer Online Medical Opinions

Stephen Kovacs, D.O., sees patients with lung problems all day long as a pulmonologist at Saint Vincent Hospital.

His plan is to help even more patients through a new online business he has formed with two other physicians, a lawyer and software architect Jamison Krugger.

Green Lighting LED Launches Buy American, DLC Listed LED Tubes

Green Lighting LED, known for offering the longest full replacement warranties in the LED industry, expanded its USA manufacturing efforts to include LED tubes. Exceeding 100 lm/watt on all of its tubes, the company offers a full replacement 7 year warranty on its product line – exceeding low quality tube manufacturers’ limited warranties of only 3 to 5 years.

Gannon University’s Technology Business Accelerator Business Pitch Winner Takes Home $10,000

The winner of Gannon University's Technology Business Accelerator business pitch event went home with a $10,000 check, along with six months of residency, coaching and strategic mentoring from the Erie Technology Incubator this morning.

Corbett Administration Awards Grant to Gannon University for Regional Entrepreneurship Programing

Continuing to advance Governor Corbett’s JOBS1st PA initiative, Department of Community and Economic Development Secretary C. Alan Walker today announced the award of a Discovered in PA – Developed in PA grant to help launch the Integrated Business Transformation program which is designed to fast track the creation and development of technology-enabled businesses in Northwest Pennsylvania.

Erie Entrepreneur graduates From Erie Technology Incubator

The Erie Technology Incubator at Gannon University (ETI) is pleased to announce the graduation of Green Lighting LED and its upcoming move to a new manufacturing, fulfillment, and administrative office location at 1856-B East 10th Street, here in Erie.